It is essential to manage the balance of software skills along with basic Managerial Accounting skills, communication and customer service skills. An impeccable combination of all these skill sets is important to become successful.

I know several accountants anywhere from 10 to 30 years older than me, and all of them are very successful and enjoying life. This career tactic is very useful, as outgoing public accountants are treated like war heroes by accountant-hungry companies, for all their “noble work” performed. As an accountant, I essentially am required to learn the ins and outs of a variety of companies of all different sizes. Whether it’s the audit, tax or advisory service line, my mission is to become an expert in my client’s business. A credit is an https://personal-accounting.org/should-you-leave-a-tip-for-the-waiters-if-the/ entry that either increases a liability or equity account, or decreases an asset or expense account.

Accountants are in high demand, as reflected by their high salaries. For accountants who want to make the most money, knowing the top-paying industries or sub-sectors and locations can help them plan their career paths accordingly.

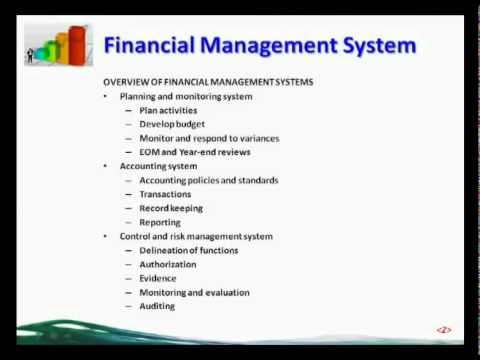

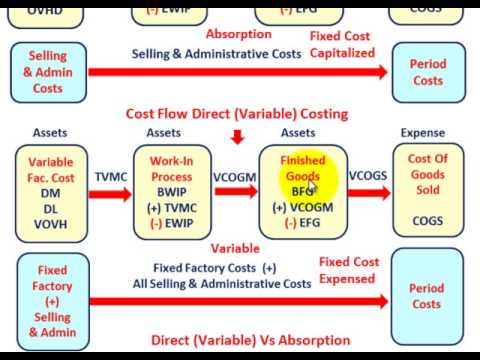

The ARPL is a coalition of various advanced professional groups including engineers, accountants, and architects. Two important types of accounting for businesses are managerial accounting and cost accounting. Managerial accounting helps management teams make business decisions, while cost accounting helps business owners decide how much a product should cost.

Not Your Father’s Job: Why More Millennials Are Getting Into Accounting

One must search the course most appropriate as per his requirement. It requires advanced knowledge, which is only possible through rigorous reading and strong experience.

It is an accountant’s responsibility to help and navigate their customers through taxation procedures in the most ethical and hassle-free way. An accountant should have an in-depth understanding of various taxes, tax income limits, taxable items, tax rates, etc. However, there are certain jargon, buzzwords and basic accounting skills that are considered as a prerequisite to becoming a successful management accountant.

Accounting is school is difficult at times because it’s a very different way of thinking that isn’t always intuitive for people and requires you to understand/memorize A LOT of information. Accounting is considered one of the harder business majors because it’s up against majors like marketing, management and business admin. Also, most other business majors are a cakewalk at most schools, so of course accounting is considered the hardest because it’s the most concrete (aside from finance). When I was taking my business core classes, I was shocked by how much other majors would bullshit their papers/answers and still do well.

An accountant needs to earn certification from authorizing body to enjoy lucrative monetary rewards and to sustain in the market. Certified Public Accountant course curriculum includes 30 hours of accounting study. Similarly, in the market, there are many certifications available in the realm of accounting space.

- Entries are recorded in the relevant column for the transaction being entered.

- Many accountants, especially those with CPAs and advanced degrees, can earn six-figure salaries, sometimes after just a few years of work experience.

- This paper begins with an overview of the cross-centurial evolution of the accounting thought to date.

- Also, changes were made from Using the “Delphi Technique” based on the view of 14 people of professional and academic experts.

- The Financial Accounting Standards Board (FASB) stipulates GAAP overall and the Governmental Accounting Standards Board (GASB) stipulates GAAP for state and local government.

- It’s helpful to list the current and fixed liabilities individually on the balance sheet before adding them together so you don’t get confused.

According to the Journal of Accountancy, students who earn the Certified Public Accountancydesignation have a competitive edge. There’s also a demand for accountants who earn a master’s degree, and so some schools offer an accelerated bachelor’s degree/master’s degree program. The lucrative salary is based on demand and makes accounting one of the best business jobs. On average, accountants and auditors earned a mean annual wage of $70,500, as of May 2018, according to the U.S. Actual wages might be higher or lower, depending on industry and location, but they are well above the national median average for occupations.

Microsoft Excel or other spreadsheet software are invaluable to accountants, as they help you track numbers in a graph or conduct calculations to create a finance spreadsheet. Even if you know the basics, you can always brush up and learn intermediate or advanced skills for creating spreadsheets, charts, and graphs. “Hiring at public accounting firms hits all-time high.” Accessed Nov. 13, 2019.

Accountants can earn a lucrative salary, especially if they work in the sub-sectors or cities or areas listed below. We will present the basics of accounting through a story of a person starting a new business. The person is Joe Perez—a savvy man who sees the need for a parcel delivery service in his community. Joe has researched his idea and has prepared a business plan that documents the viability of his new business. Luca Pacioli is considered “The Father of Accounting and Bookkeeping” due to his contributions to the development of accounting as a profession.

Around the first millennium the Phoenicians invented an alphabetic system for bookkeeping, while the ancient Egyptians may have even assigned someone the role of comptroller. Olivia F. Kirtley becomes first woman President of the International Federation of Accountants (IFAC). Studies have shown that one of the best ways to alleviate poverty is through employment.

Considering South Africa’s high unemployment rate, it is clear that unemployment contributes to poverty and low household net wealth. Using data obtained from a representative omnibus sample, this paper analysed the effect of employment status on a household’s net equity (assets minus liabilities). In order to determine the cause of the equal distribution, the paper investigated whether the occupation in which a person is employed might assist in explaining the differences in the net equity values. If you’re looking to switch careers, https://personal-accounting.org/ might be the answer. Financial professionals who have deep accounting skills and knowledge earn solid salaries, put themselves in serious demand, and make a real difference for the organizations they serve.

For the average person, learning accounting can be a way to enter the lucrative accounting profession or can simply make one more competitive when applying for a variety of other jobs. The Going Concern Principle assumes that the company will remain in operation for the foreseeable future, and requires the accountant to disclose any information regarding the compromised future or certain failure of a company.

Regardless of the size of a business, accounting is a necessary function for decision making, cost planning, and measurement of economic performance measurement.

An Italian mathematician and friend of Leonardo da Vinci, Pacioli published a book on the double-entry system of bookkeeping sometime between 1470 and 1517. The Alliance for Responsible Professional Licensing (ARPL) was formed during August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient.

A debit is an Annual holidays entry that either increases an asset or expense account, or decreases a liability or equity account. It depends on where you live, but in the United States the average salary for accountants is $67,190. If you are a business owner, establishing and maintaining a proper accounting system is crucial to running a successful business. It allows you to properly file your taxes, keep track of your finances, and study your operations so that they may be improved.

Down the road, a MAC degree allows you to take on any role — from entrepreneur to nonprofit executive to government leader — that requires accounting and business knowledge. A master’s degree in accounting gives you sophisticated analytical skills that are important in all professional roles.

How to Learn Accounting on Your Own

In other words, if an accountant believes the company will go bankrupt in the foreseeable future, he is obligated to disclose that information to investors and any other interested parties. If the company is a large corporation, the equity may belong to stockholders; if the business is owned by one single person, then the equity is an Owner’s Equity. This means that when asset accounts, like cash, are debited, they are increased. However, when liability accounts, like accounts payable, are debited, they decrease.